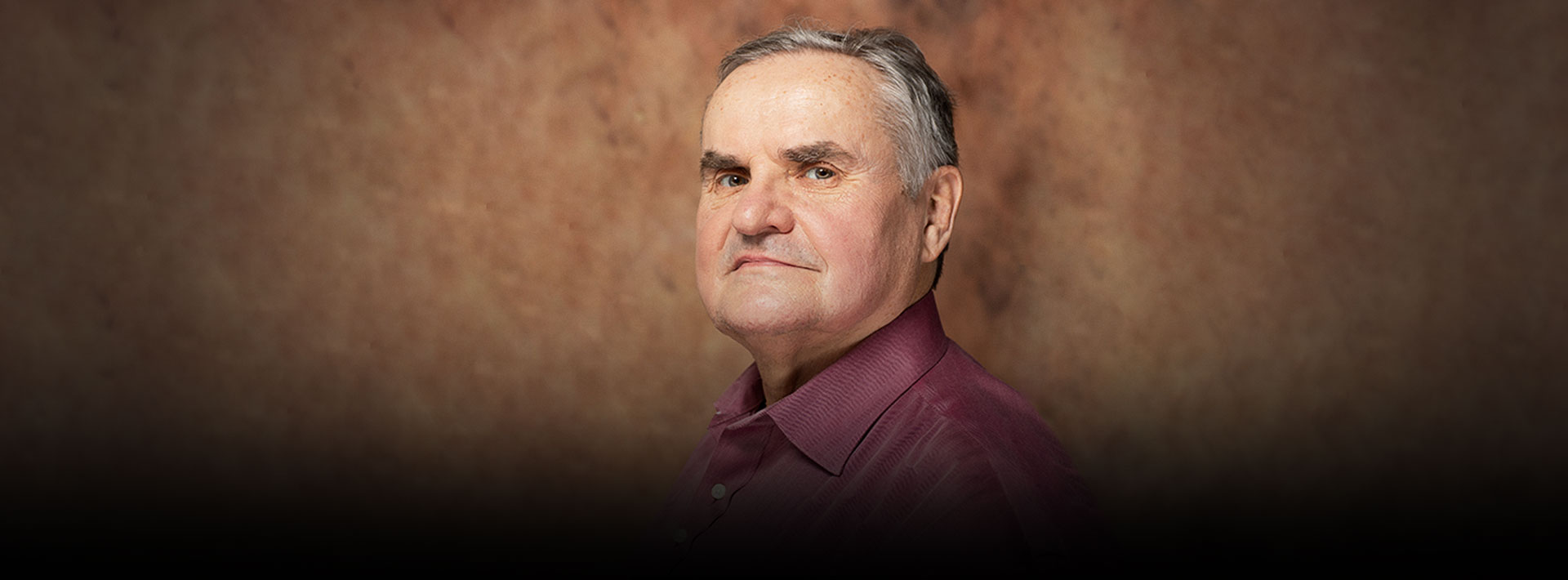

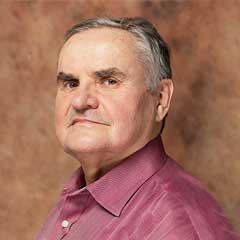

StageYou Interviews John Ason on how Startups are disrupting and reshaping entire industries due to digitalization

John Ason is a professional angel investor with over 22 years of experience. In that time, he has made over ninety eclectic investments in the areas of e‐commerce, technology, advertising, digital social media and entertainment. Among some of his well-known investments were Xlibris, LiveLOOK, Diapers.com, Centrak and Jet.com. The sum total of all his exits exceeds $4 billion. Some of John’s current interesting companies include ScentBird, Tunity, Hi.Fi, TwoSense.ai, Primary, Trendalytics(Trendalytics.co), GeoCV, Navigine, HYPR(HYPRbrands.com), Owlet(Owletcare.com), Monaeo, EquityZen, Battlefy, CallunaVineyards and Koding. Throughout John’s portfolio of startups, one will find many examples where startups not only gained a competitive edge but also disrupted their industries. Recently, StageYou sat down with John to understand how digitalization is empowering startups to reshape entire industries.

StageYou: Could you introduce your philosophy as an investor in the context of digitalization?

John: As an angel investor what I do is invest in companies from a variety of industries with some minor exceptions. What I look for is how I can apply digital technologies like analytics, Internet, blockchain, and more. With such technologies, we aim to improve efficiency, save time and provide goods and services at a more cost effective price.

StageYou: Over the years, you’ve made quite a few high-profile investments. There’s Diapers.com, Amazon acquired for US$ 545 million. Another was Jet.com, Walmart acquired for US$ 3.3 billion. Could you share with us how digitalization allowed them to gain a competitive edge?

John: In the case of both Diapers.com and Jet.com, our biggest competitor was Amazon. We applied digital analytic technologies to gain a competitive edge. In the case of Diapers.com, we explored delivering the same product Amazon was selling more efficiently. We ran calculations to identify the smallest volume in terms of boxes that would be shipped. Afterward, we were able to introduce robots into our warehouses to retrieve shelves of products and bring this shelf to the pickers and packers who were then instructed on the order of packing the items.

In the case of Jet.com, much of its digital technology focused on the checkout basket. Each time a customer added an item to the checkout basket, we’d recalculate the cost of sourcing and shipping the items. Also, if the customer was using a debit card then the fees were cheaper. If a customer agreed not to return an item prior to ordering then the cost of the potential return would be eliminated. In both cases, the savings would be passed on to the customer.

StageYou: Through digitalization, both startups reduced logistical barriers to make their operations more efficient and cost-effective. Are there any other startups you’ve invested in that have similarly utilized digital technologies to disrupt their respective industries?

John: Certainly! Another startup I invested in was Scentbird. We offer a monthly subscription of a name brand perfume for US$14.95 per month. So our customers need not spend $70 – $150 on a bottle of perfume. Instead, they are able to try different perfumes for different occasions like work, dinner, travels, and more. Further, Scentbird collects data about the demographics of its customers and is able to provide better services for our customers. Superficially, we look like we are competing with existing perfume companies but in reality we are revitalizing an old staid industry and increasing their volume.

Similarly, there’s the story of Trendalytics. It helps store buyers and brand managers identify fashion trends. We collect and analyze data across social media platforms, sales data, SEO data etc. On average, we are collecting data from over a trillion data points every day. By identifying these trends, we determine the fashions, which will sell better in the next quarter. Currently about 60% of all fashion items are sold at a discount. Through the use of our information this number is reduced by 2 to 3% thereby increasing profit margins.

StageYou: Digitization has allowed these founders to make a breakthrough in their respective ventures. So as an angel investor, how do you collaborate with them?

John: The way I work is that I don’t predict the future. Instead, I outsource that to the founders. I receive nearly 4,000 proposals a year. I spend one minute going over their one page executive level summary. If I like what I see, then I’ll request a meeting with the founder if I find them fundable. I’ll assist the founders in fine tuning their strategy. Afterward, I only step in if requested, As I have experience in a variety of industries I bring different business models and cross apply to their relevant industry customizing it to suit the needs of their industry . I also focus on achieving leverage through technology and assist them when making a pivot. Otherwise, I give founders freedom because they are the best qualified to make decisions.

StageYou: You mentioned that you receive 4,000 proposals a year. A staggering amount. Yet you only spend a minute analyzing the executive summary on each proposal. Could you share with us what you are looking for in that one minute?

John: It took me 10 years until I could spend only a minute analyzing them. The first thing I check is if it’s organized and aesthetically pleasing to look at. It’s a clear indicator of whether the founder has vision, organization and structure. At this point, over half of the executive summaries get deleted.

The next thing I look for is an explicit statement of what the company does. I don’t want to know the features of the product or the benefits to the customer. I want a simple explanation of what the company does. About 40% of companies that reach out to me lack such statements. In my experience, companies without it have trouble communicating with programmers, salespeople, and other stakeholders.

The third aspect I analyze is the people. I want to see if I can work with them and if they have the intelligence and perseverance to succeed. I then want to see how much money they need, which must provide for 12 to 18 months of operations. The last thing I look at is the product. The easiest thing to change is the product but you can’t change the people or the market.

StageYou: You’re actively known as a mentor at various high caliber accelerators such as Entrepreneurial Roundtable, DreamIt and TechStars. From your experience could you share how investors can find credible startups to invest in?

John: Over the years I’ve funded indirectly approximately 300 companies through VC funds and accelerators. Currently, I have direct investments in 14 international companies. For these companies I require a local presence through venture capitalists and angel investors. I normally communicate with these companies via email. I might only see their founders personally once or twice a year.

Now if an investor wants to connect with startups, accelerators are the best place. Currently, I mentor startups at Techstars, DreamIt, Starta and the Entrepreneur Roundtable accelerators. This is an arrangement I’m fond of since the startups are pre-screened and go through an intensive 4 month program. So you get a set of determined entrepreneurs. All of them desire to make an impact and I want to help them. For me, it’s not about making money, but helping entrepreneurs make an impact.

Furthermore, through this mentoring process, I can see how the entrepreneurs react when they receive new information. These programs help gauge how entrepreneurs work with investors. For example, I met the founder of ScentBird through the Entrepreneur Roundtable Accelerator. Its original idea was to send three bottles of perfumes to the customer who’d pick the one they liked and return the other two. Every investor, including myself, believed it couldn’t work due to the logistical complexities. Yet, the founder took our advice positively and pivoted towards a subscription model. Through these accelerators, an investor gets to work with a startup before deciding to invest.

StageYou: What advice would you give to an entrepreneur who approaches you to invest in their startup?

John: For entrepreneurs seeking funding, my advice is to be as short as possible. Eliminate words because words are your enemy. Don’t give lengthy explanations about the product with market forecasts from big consultants. Keep things simple, tell me what you’re doing very specifically and how big your addressable market is. Further, you should know how much money you need to stay in business for up to 18 months. Finally, with each round of funding, irrespective of the amount you are seeking you should only give up only 20 – 30% of equity.

StageYou: What advice would you give any new angel investors?

For any new angel investors, my advice would be to have US$ 250,000 in the bank to invest in startups. You can then invest US$ 25,000 across 10 companies. However, before you invest, select an industry you would like to specialize. There are multiple options you can choose from today like fintech, manufacturing, e-commerce, etc. You should diversify your portfolio with investments because there’s a high degree of risk involved. Typically, my investments in early-stage companies have a 90% failure rate. That’s an extreme failure rate but when you succeed you can expect a 10x return on your initial investment.

Secondly, as an angel investor, you shouldn’t take money for consulting. If you do, it’s not fair to other investors. It can be detrimental if other investors do the same since not every investor will offer high quality advice. So you can be in the business of consulting or building big businesses. I’m in the business of building big businesses. I don’t want short term revenue that can limit the growth of the company.

Thirdly, if an angel investor wants to find companies, then I’d send them towards incubators, accelerators, or anywhere else with a lot of companies. However, when new angel investors are thrown into such environments, they tend to invest in substandard companies. In my experience, I’ve also met frustrated angel investors that fell in love with such companies. However, they couldn’t write a cheque because they knew they’d lose their entire investment. These are the things that young angel investors must overcome.

Lastly, an angel investor shouldn’t throw money at a company after a bad investment. Sometimes a company may not be doing so well. It’ll go to their investors saying, “If you invest a bit more money then you can save your initial investment.” To me, the money I initially invested is gone the moment I wrote the cheque. Any new investments I choose to make will be based on new information.

StageYou: You have a vast portfolio of startups that have harnessed the power of digitalization. So what was your greatest success as an angel investor?

John: My greatest success story as an angel investor would be a company called Centrak. It offers a real time location system, which provides precise and low cost platforms for healthcare solution providers. Through this system, healthcare providers can keep track of their personnel and resources. Centrak was acquired by Halma for US$140 million. What makes it special is that Centrak received zero funding from VC firms. It was purely funded through angel investors and went through multiple pivots. Also one of my greatest successes in life is my daughter, who also became an angel investor.

StageYou: You mentioned that your daughter becoming an angel investor was your greatest success in life. Could you share with us your contributions to female entrepreneurship?

John: Currently, I work with 21 female founders across 17 companies. I’ve also helped organize 37Angels, which is a community of female angel investors. They run programs and boot camps, and meet 4 – 5 times a year. With each batch, they accept 7 or 8 companies where the founders can be either male or female. My main focus at 37Angels is to be a mentor for its female angel investors. One of the female angel investors I mentored is now a partner at a VC firm. Similarly, I also work with Astia, based in San Francisco. Additionally, over 50% of the companies the ERA accelerator invests in has female founders.

In summary, digitalization allows startups to eliminate logistical barriers, be more cost-effective, and increase efficiency. It allows startups to analyze data from over a trillion data points and deliver insights that result in increased profits. Digital technologies have allowed startups to disrupt entire industries. For angel investors accelerators are a great place to meet the founders behind such startups. There are many things a new angel investor must know. Similarly, there’s much a founder needs to know before they get funded. However, thanks to digital tools like email and video conferencing, it’s now possible for founders and angel investors to successfully collaborate while being located halfway across the world.

John Ason

John Ason has been an angel investor for over 22 years specializing in early stage pre‐revenue companies. He has made over ninety eclectic investments in the areas of e‐commerce, technology, advertising, digital social media and entertainment. Of his ninety companies there are 21 female founders, 14 international companies and 30 currently active companies. Some of John’s notable exits include Xlibris, LiveLOOK, Diapers.com, Centrak, and Jet.com. The sale price of these exits exceeds $4 billion.

A typical company consists of one or two people in a garage or kitchen with minimal or no revenues. Any capital efficient industry with high growth potential qualifies with the exception of medical and biotech. As a starting point, John will accept only one page executive level summaries via email (ason@comcast.net).

Prior to being an angel investor John had a career at AT&T Bell Labs. He spent the first ten years doing bleeding edge technology development and then 15 years marketing large telecommunications systems to international telecommunications companies. John guest lectures at NJIT, Fairleigh Dickinson, Rutgers, NYU, Columbia and Wharton. John is a mentor at the Entrepreneurial Roundtable, DreamIt and TechStars accelerators. John is an advisor to the Astia, 37Angels, Vinetta Project and Springboard women’s organizations. John has a BS in Mathematics from the Illinois Institute of Technology. John Has been a guest in 15 countries speaking at conferences, participating on panels and pitch sessions and discussing startup ecosystems with governments. John’s hobbies include traveling, golf, Go (Asian game) and mentoring companies. Please visit his website at JohnAson.com and his interview at